This evaluation, combined with my private trading expertise, has led to the findings and analysis offered beneath. These highlight one of the best forex brokers throughout varied classes tailor-made to your particular trading needs. Within the different sorts of Cryptocurrency foreign exchange broker, you even have two completely different order book kinds. The time period “prime broker” typically refers to a financial institution that provides a variety of providers to institutional investors, hedge funds, and different giant purchasers. No-spread brokers will sometimes earn their residing from commissions or other avenues, however the regularity of zero spreads is a boon for so much of trader varieties. The broker will trade in opposition to retail traders if clients’ solutions counsel they have a day job, want to fund the account with a small amount, and haven’t any financial background.

Using The Trading Platform, Trading Is Simple

We don’t provide financial advice, supply or make solicitation of any investments. There are many scam brokers on the market, so you have to watch out not to fall a sufferer to any of them. An advantage supplied by some ECNs is that the trader posting the worth could be given some degree of anonymity. This can suit merchants who don’t wish to give away the truth that https://www.xcritical.in/ they are on the bid or offer. The market maker’s goal is to capture a portion of the unfold and to do enough quantity on either side of the market to avoid having to put off amassed risk with one other professional counterparty. Though uncooked unfold accounts are desirable, there are some factors to contemplate while choosing one.

Kinds Of Foreign Exchange Brokers Based Mostly On The Business Model

- I also found there are a range of order sorts that are not out there on other platforms and some which may be new to me.

- A requote occurs when the price that you simply intended as your entry level to commerce modifications before that trade is enacted, which spurs a new worth quote (a requote).

- This means you probably can place orders at prices that are very close to the present market worth – a singular feature amongst brokers.

- This brokerage model provides high transparency and facilitates both skilled and institutional traders.

- This decision is commonly based on a spread of factors including the size of the trade, the trading profile of the client, the client’s successful fee, market situations, and the chance administration strategy of the broker.

While these are the ‘go-to’ platforms for foreign exchange merchants, they do have a learning curve, so it’s properly value going via the guides. Alternatively, beginners can use the Octa Web Platform, which shall be simpler to get began with. OCTA provides an extensive vary of analysis and educational materials useful for beginner merchants who are just starting out. Founded in 2011, one entity is authorized and controlled by CySEC, and one entity is not regulated. Beginner traders can access a free demo trading a-book broker account and a commission-free trading account to commerce 80+ monetary instruments.

Finest Should Read Foreign Currency Trading Books

There’s lots of technical jargon that’s used when describing forex brokers. Some of what you read or hear about are most likely outdated, inaccurate, and even deceptive. Customer service ought to provide easy access to the help and buying and selling desks by way of chat, telephone and e mail.

Can I Commerce Forex With No Broker?

A hybrid Forex dealer represents a modern and more and more common method in the Forex trading industry. In this setup, the dealer all the time initially acts as the counterparty or market-maker to the trades their shoppers place. However, the greatest way they deal with these trades after the fact varies and can encompass different fashions, such as A-book, B-book, or ECN or STP strategies, relying on numerous circumstances. A Direct Market Access (DMA) Forex broker is a kind of dealer that, like others, initially acts because the counterparty to trades made by their purchasers. The broker you choose should act as a companion, supplying you with entry to tools that enhance your confidence when trading in risky financial markets. Brokers with a great reputation will have a number of tools obtainable to assist their customers turn into better traders.

The monetary merchandise offered by the promoted corporations carry a high degree of threat and may end up in the lack of all your funds. A straight-through processing (STP) brokerage has adopted a mannequin of order processing that makes your commerce execution quicker and supplies a excessive level of transparency. Here at Forexbrokers.internet, we take delight in helping our readers find the absolute best financial service suppliers and avoid fraudsters.

This is one other version of NDD, the place the dealing desk is eliminated, and your orders go directly to liquidity providers. Electronic Communication Network (ECN) brokers provide you with direct access to the interbank market, allowing you to execute your trades with minimal interference. My name is Mircea, and I am an MBA in International Business graduate, Magna Cum Laude, from American University. I love monetary markets and have been trading for a dwelling for greater than a decade.

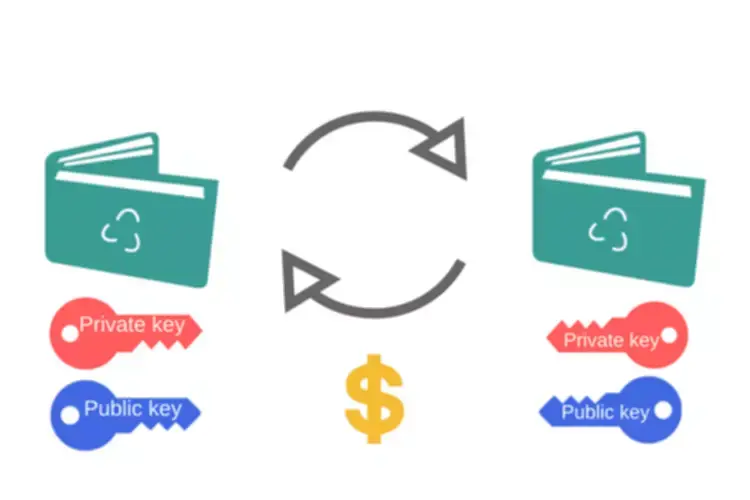

Once you’re conversant in the A-book and B-book ideas, the following classification to contemplate is expounded to execution methods. This consists of Market Makers (MM), Electronic Communications Networks (ECN), Straight Through Processing (STP), and Direct Market Access (DMA). Each of those execution types has distinct characteristics and implications for a way trades are executed and at what pace and value. Your deposit is made to your dealer, and it’s their accountability to maintain funds in accounts segregated from their own.

Brokers earn from commissions and different charges, and all brokers have a eager interest in serving profitable traders. Some brokers that run huge businesses cut exclusive deals that earn them a small fee on each deposit. For occasion, the costs of funding an account by way of financial institution wire or credit card differ. Ultimately, the retail trader pays the commissions, however brokers have their cuts too. For this cause, and knowing that almost all retail traders fail in the long run, many ECN brokers run a market-making enterprise too. They cope with purchasers to learn from the percentages that the traders won’t make it in the long run.

In addition, there’s a distinct regulating physique in each space and nation. Therefore ECN brokers may set their minimum account balances from $1,000 to $50,000, which is usually too excessive for beginner traders but perfect for extra superior and skilled merchants. That is what we will do for you here, explaining every thing in layman’s terms. Once you’ve made your means by way of this information, you must have a transparent understanding on the various sorts of foreign exchange dealer so as to make an informed determination as to which is greatest for you. Depth of Market shows the place other market members have their purchase limit and promote restrict orders.

If you trade $50 million or extra in notional month-to-month quantity, you’ll find a way to entry a 5% spread cashback rebate, which is the equivalent of $5 per million (USD) traded. This rebate may be withdrawn or used within the buying and selling account to open new trades. RoboForex has created its own R StocksTrader platform and app designed particularly for stock trading. The dealer additionally helps the popular MetaTrader 4 and 5 platforms, which may be enhanced with add-ons for direct entry to buying and selling indicators. Moreover, RoboForex supplies free Virtual Private Server (VPS) internet hosting, enabling low-latency trading for its users. However, aggressive trading costs are available via the Raw+ and Elite Accounts.

60-90% of retail investor accounts lose money when buying and selling CFDs with the suppliers introduced on this site. The data and movies usually are not funding suggestions and serve to clarify the market mechanisms. An unregulated forex dealer is a forex brokerage that operates without oversight from a recognized monetary authority or regulatory physique. Some brokers go to extreme lengths and offer personalized conditions to their purchasers when it comes to spreads and commissions. Most DMA brokers have already got partnerships with the LPs, so they combination clients’ orders and forward them to their LPs for execution at one of the best rates. Pricing can be obtained from the LPs, aggregated, and presented to the dealer on the platform.

Understanding these variations is crucial for making informed choices. Selecting the right international dealer is a cornerstone for fulfillment in the forex market and the stock market. With access to superior buying and selling tools, robust buying and selling platforms, and sources like academic materials, traders can align their buying and selling targets with the best options. Brokers like Interactive Brokers Group cater to skilled traders and seasoned traders, offering tools such because the Trader Workstation and help for multiple currencies. From foreign currency trading and mutual funds to mounted revenue merchandise and replica trading, the most effective brokers guarantee regulatory compliance and provide user-friendly platforms. Additionally, negative steadiness protection, direct access to world markets, and commission-free trades improve the trading expertise.